US Dollar sinks to daily lows near 91.60

The greenback, gauged by the US Dollar Index (DXY), stays on the defensive so far today and is currently testing the lower bound of the range in the 91.65/60 band.

US Dollar attention to data, Fed

The index remain unable to gather some upside traction so far this week, all against the backdrop of uncertainty over Trump’s tax reform plans and rising scepticism among investors.

The greenback is expected to keep the familiar range for the time being in light of tomorrow’s FOMC gathering. Market consensus sees the Federal Reserve sticking to its monetary status quo this time. This scenario is also reinforced by CME Group’s FedWatch tool, which places the probability of a ‘no move’ by the Fed at nearly 99%, always based on Fed Funds futures prices.

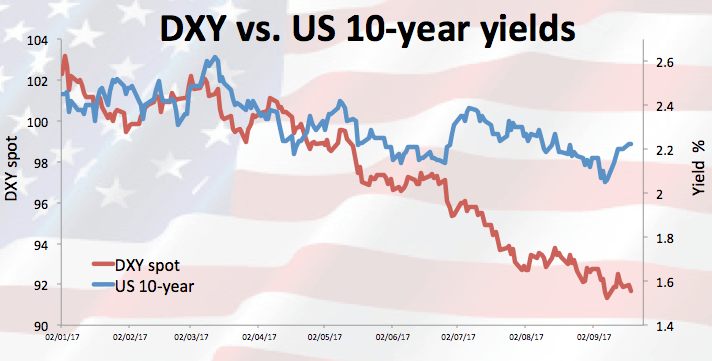

The down move in DXY seems to have decoupled from US yields dynamics, particularly the key 10-year benchmark, which are so far navigating the area of 5-week tops around 2.23%.

In the US data space, housing starts, building permits and August’s import/export prices are next on tap seconded by the usual weekly report on crude oil supplies by the American Petroleum Institute (API).

US Dollar relevant levels

As of writing the index is retreating 0.14% at 91.68 and a breakdown of 91.58 (low Sep.15) would open the door to 91.01 (2017 low Sep.8) and finally 89.65 (low Dec.25 2015). On the upside, the initial hurdle aligns at 92.20 (high Sep.18) followed by 92.37 (21-day sma) and then 92.66 (high Sep.14).