Back

14 Jun 2018

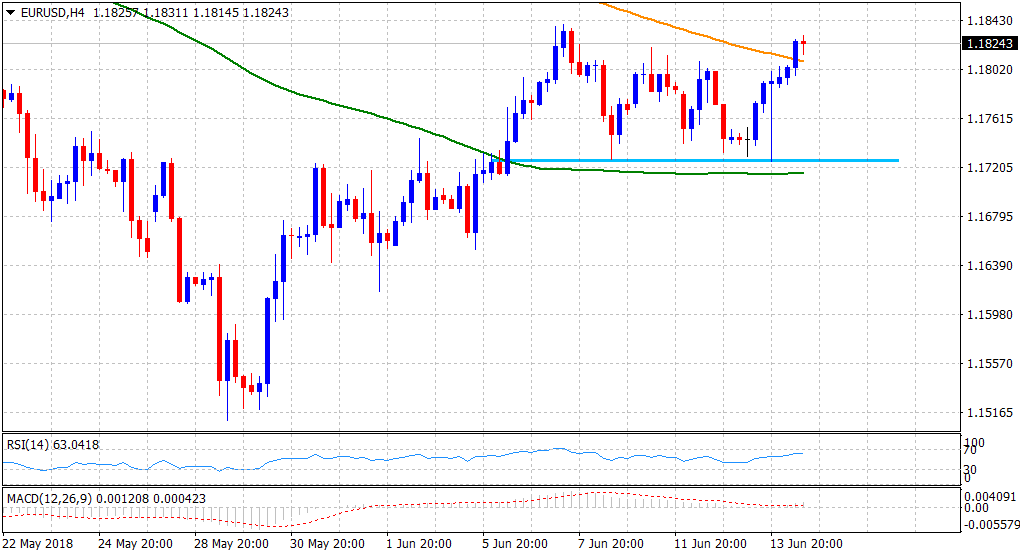

EUR/USD Technical Analysis: awaits ECB for bullish confirmation

• The pair built on its post-FOMC up-move from an important horizontal support and is now holding comfortably above the 1.1800 handle.

• Short-term technical indicators oscillating in positive territory and a move above 200-period SMA on 4-hourly chart clearly points to near-term bullish bias.

• Only a dovish ECB outlook would negate the positive outlook and turn the pair vulnerable to head back towards challenging the 1.1725 support.

EUR/USD 4-hourly chart

Spot Rate: 1.1824

Daily Low: 1.1787

Trend: Bullish

Resistance

R1: 1.1840 (June 7 swing high)

R2: 1.1897 (R3 daily pivot-point)

R3: 1.1973 (50-day SMA)

Support

S1: 1.1800 (round figure mark)

S2: 1.1773 (daily pivot-point)

S3: 1.1726 (overnight swing low)