Back

19 Nov 2018

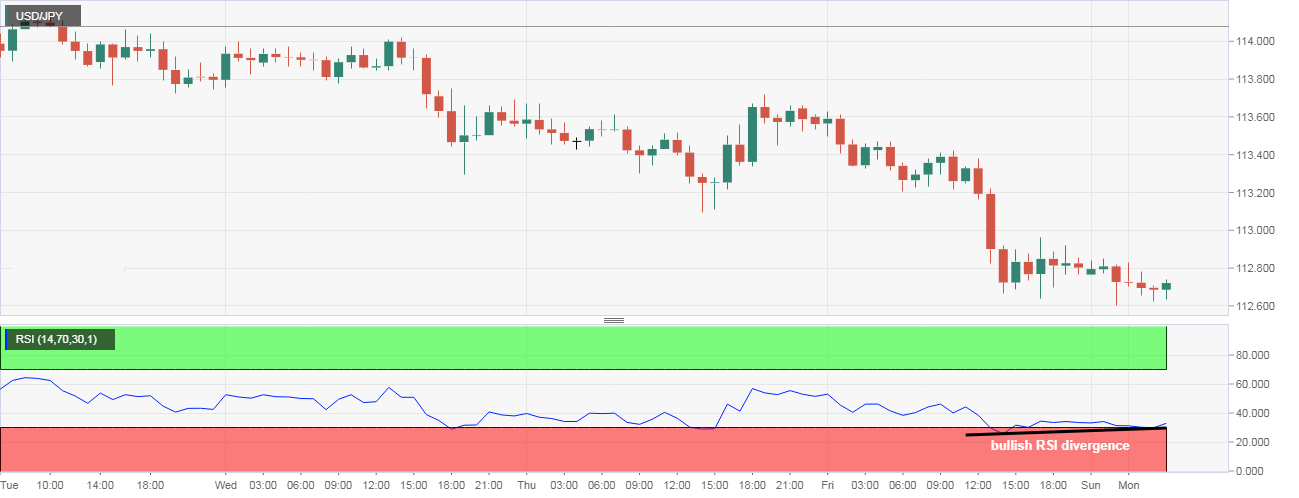

USD/JPY Technical Analysis: hits 17-day low, 4H RSI is reporting oversold conditions

- The USD/JPY opened under the 50-day simple moving average (SMA) and hit a low of 112.61 earlier today - the lowest level since Nov. - possibly due to signs of risk aversion in the S&P 500 futures.

- The relative strength index (RSI) on the 4-hour chart and the hourly chart is reporting oversold conditions. As a result, the pair could consolidate or may see a minor bounce to the 50-day SMA of 112.84.

- The 14-day RSI has dipped into bearish territory below 50.00 and the 5-day and 10-day SMAs are showing a bearish crossover. The stacking order of the 50-hour SMA below the 100-hour SMA, below the 200-hour SMA, also indicates the path of least resistance is on the downside.

- So, minor pullback, if any, as called by the hourly and 4-hour RSI, could be short-lived.

Hourly Chart

USD/JPY

Overview:

Last Price: 112.65

Daily change: -15 pips

Daily change: -0.133%

Daily Open: 112.8

Trends:

Daily SMA20: 113.08

Daily SMA50: 112.82

Daily SMA100: 112.03

Daily SMA200: 110.14

Levels:

Daily High: 113.66

Daily Low: 112.64

Weekly High: 114.22

Weekly Low: 112.64

Monthly High: 114.56

Monthly Low: 111.38

Daily Fibonacci 38.2%: 113.03

Daily Fibonacci 61.8%: 113.27

Daily Pivot Point S1: 112.41

Daily Pivot Point S2: 112.01

Daily Pivot Point S3: 111.39

Daily Pivot Point R1: 113.43

Daily Pivot Point R2: 114.05

Daily Pivot Point R3: 114.45