When is the monthly Canadian GDP report and how could it affect USD/CAD?

Canadian Monthly GDP Overview

Thursday's economic docket highlights the release of monthly Canadian GDP growth figures for November, scheduled to be published at 1330 GMT by Statistics Canada. Market participants expect a weaker reading, showing that the Canadian economy contracted by 0.1% m/m during the reported month as against a solid 0.3% m/m growth recorded in the previous month.

Analysts at TD Securities explain: “We expect the slowdown to be broad-based aside from the drag from energy, painting a downbeat picture for Q4 growth though this is largely expected by the BoC.”

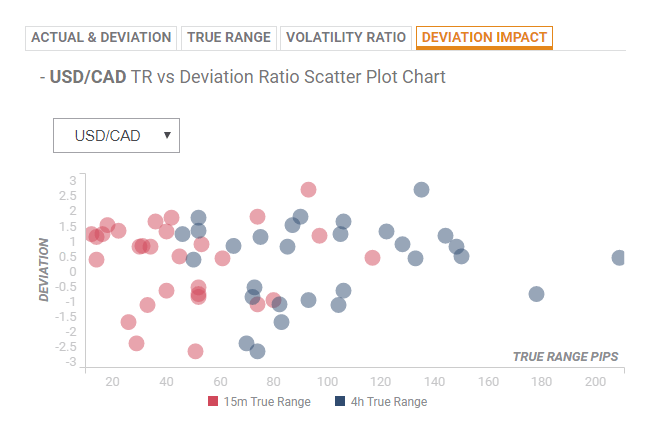

Deviation impact on USD/CAD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction on the pair, in case of a deviation between +0.82 to -0.82, is likely to be around 40-pips during the first 15-minutes and could get extended to 84-86 pips in the following 4-hours.

How could it affect USD/CAD?

Ahead of the key release, the pair was seen flirting with the very important 200-day SMA support, or near three-month lows. Even a slightly positive reading might be enough to prompt some aggressive selling and turn the pair vulnerable to break through the mentioned support and aim towards challenging the key 1.3000 psychological mark.

Alternatively, a weaker than expected reading might prompt some near-term short-covering bounce, though any meaningful up-move might be seen as a selling opportunity and seems more likely to remain capped near the 1.3200 round figure mark.

Key Notes

• USD/CAD flirting with 200-DMA support, focus shifts to monthly Canadian GDP

• USD/CAD - Downside acceleration to dominate Thursday

• Canada: November GDP likely to fall 0.1% - TDS

About monthly Canadian GDP

The Gross Domestic Product released by Statistics Canada is a measure of the total value of all goods and services produced by Canada. The GDP is considered a broad measure of Canadian economic activity and health. Generally speaking, a rising trend has a positive effect on the CAD, while a falling trend is seen as negative (or bearish) for the CAD.