EUR/USD Technical Analysis: Fiber is erasing the daily losses as spot is testing 1.1350 level

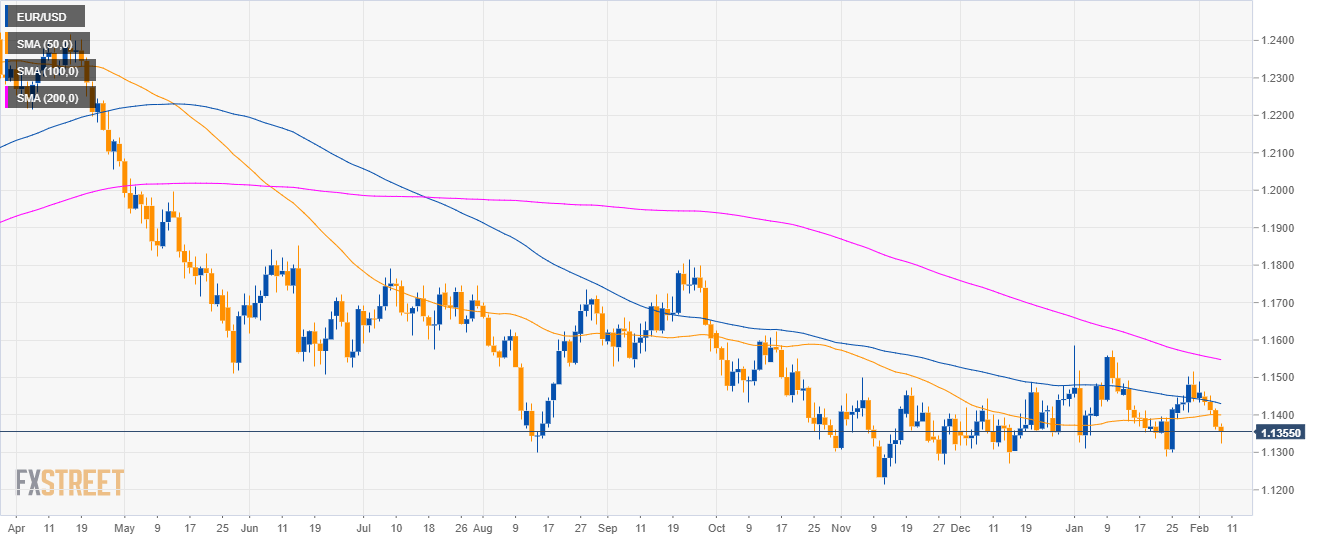

EUR/USD daily chart

- EUR/USD is trading in a bear trend below the 200-day simple moving average (SMA).

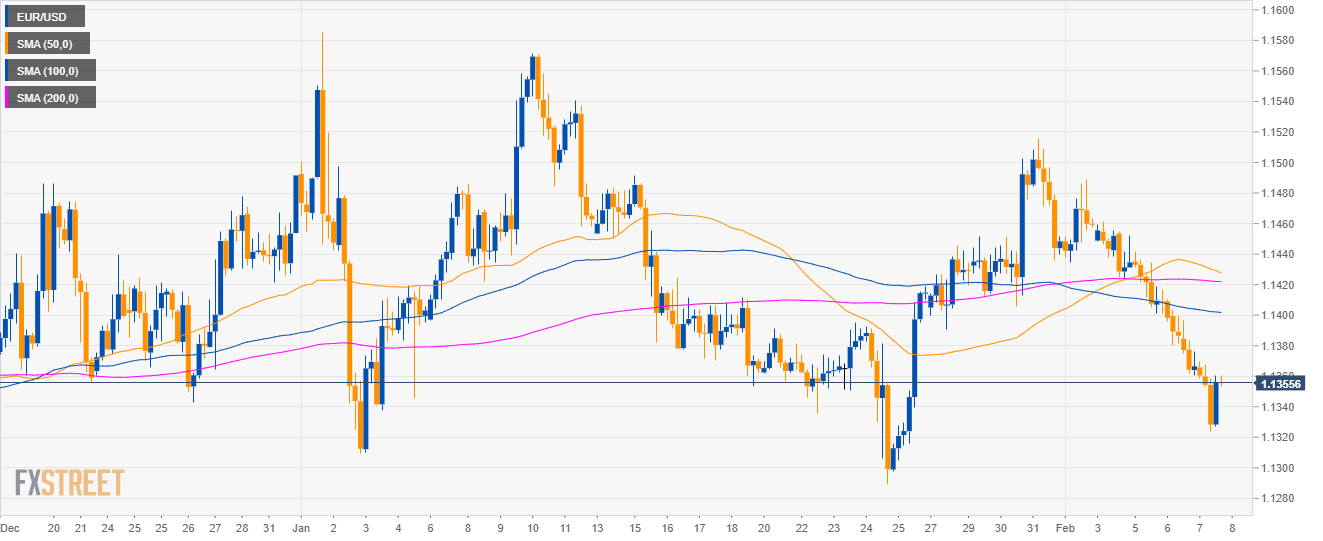

EUR/USD 4-hour chart

- Fiber is trading below its main SMAs suggesting bearish momentum in the medium-term.

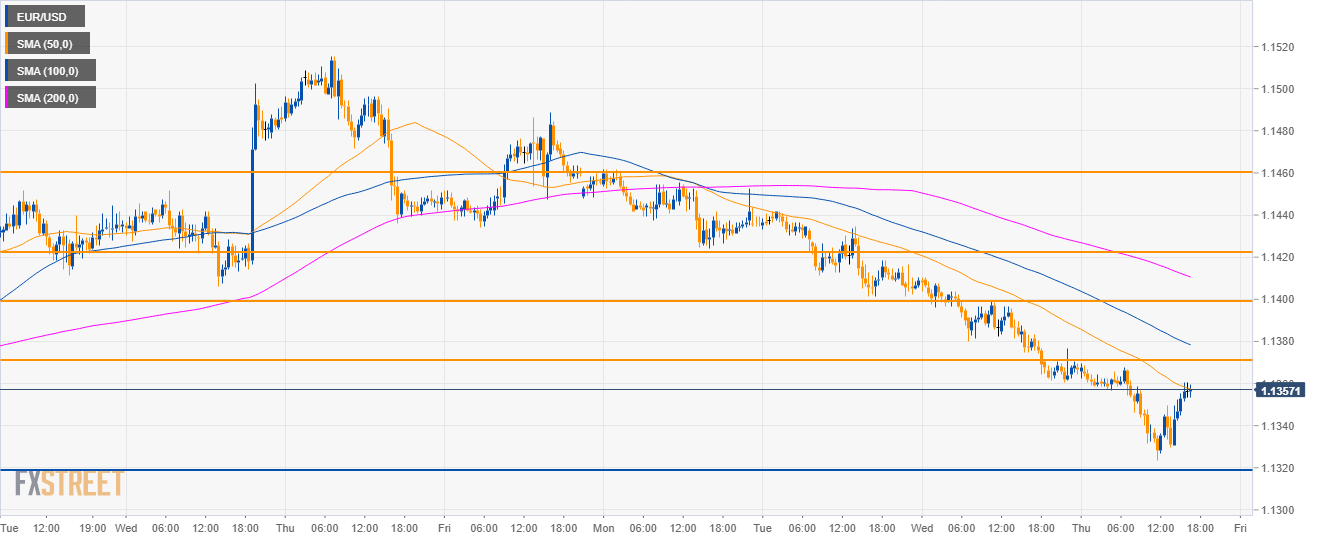

EUR/USD 30-minute chart

- EUR/USD is trading below it main SMAs. As discussed previously, the 1.1320 support was significant as the market reversed up a few pips above that level.

- It seems that bulls have what it takes to get to 1.1370 but they need a significant break above that level in order to regain some control of the market.

- Since the current momentum is bearish, sellers might still potentially come back and collapse the market to 1.13000 figure so buyers should remain prudent.

Additional key levels

EUR/USD

Overview:

Today Last Price: 1.1356

Today Daily change: -12 pips

Today Daily change %: -0.11%

Today Daily Open: 1.1368

Trends:

Daily SMA20: 1.1414

Daily SMA50: 1.1401

Daily SMA100: 1.1434

Daily SMA200: 1.1551

Levels:

Previous Daily High: 1.1416

Previous Daily Low: 1.1362

Previous Weekly High: 1.1516

Previous Weekly Low: 1.139

Previous Monthly High: 1.1586

Previous Monthly Low: 1.1289

Daily Fibonacci 38.2%: 1.1383

Daily Fibonacci 61.8%: 1.1395

Daily Pivot Point S1: 1.1348

Daily Pivot Point S2: 1.1327

Daily Pivot Point S3: 1.1293

Daily Pivot Point R1: 1.1403

Daily Pivot Point R2: 1.1437

Daily Pivot Point R3: 1.1458