GBP/USD Technical Analysis: Cable trading near 1.3030 ahead of FOMC Minutes

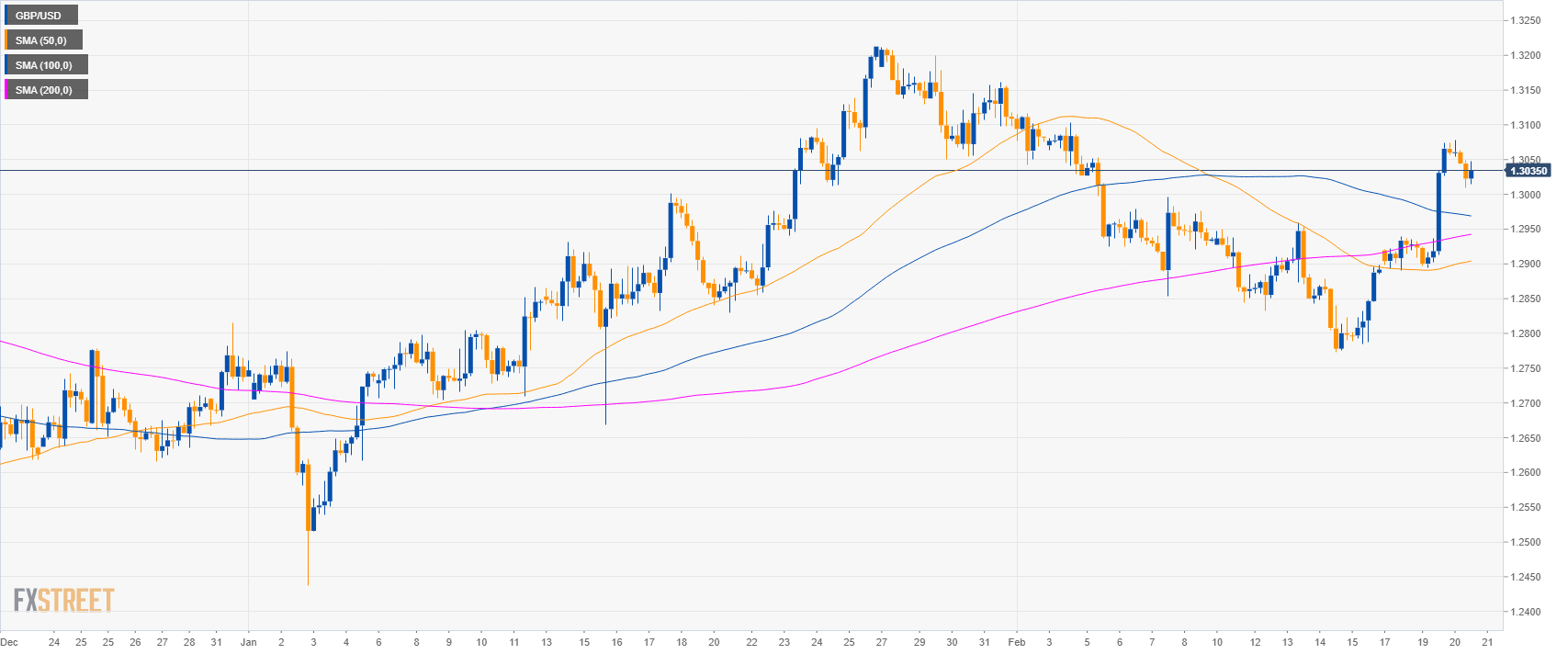

GBP/USD daily chart

- GBP/USD bulls have reclaimed the 200-day simple moving average (SMA).

- Investors are awaiting the release of the FOMC Minutes at 19.00 GMT. The news can potentially provide high volatility in the financial markets and in USD-related pairs.

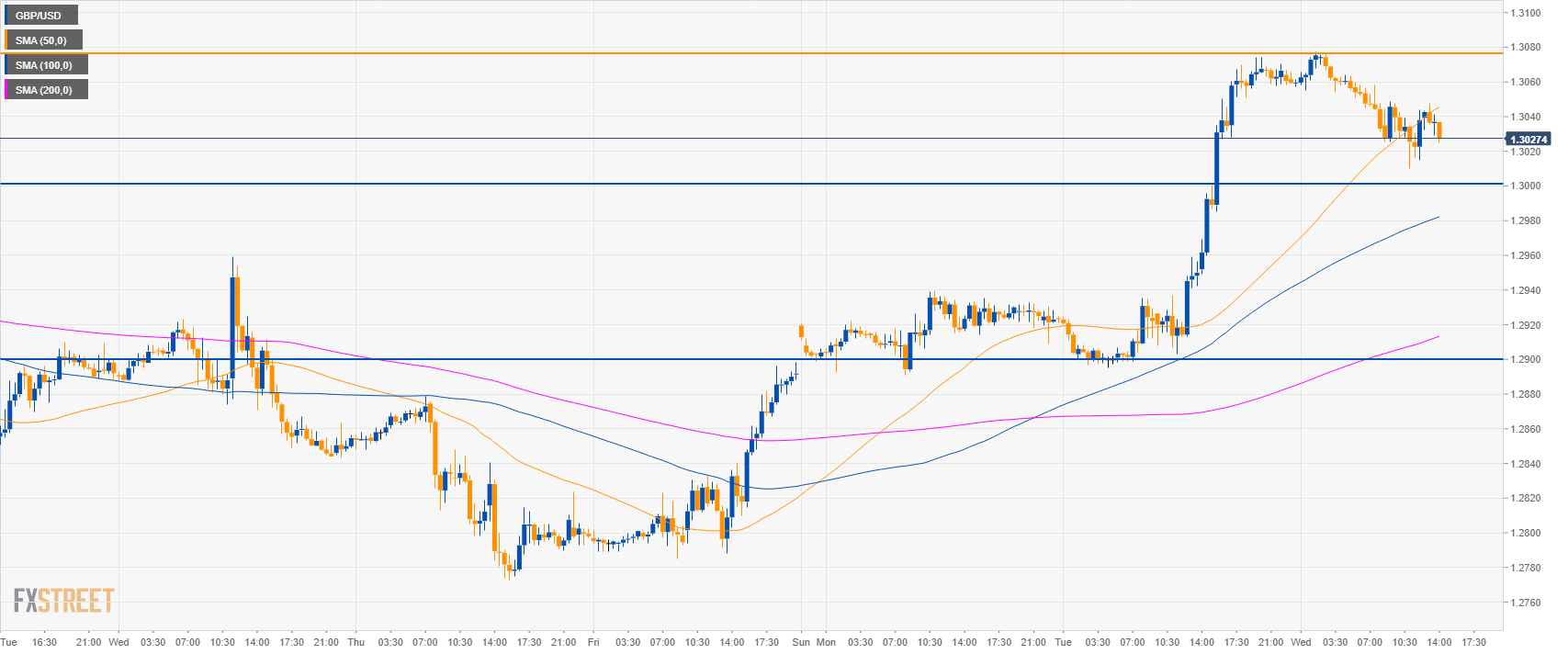

GBP/USD 4-hour chart

- GBP/USD bulls broke above the main SMAs suggesting a bullish bias in the medium-term.

GBP/USD 30-minute chart

- GBP/USD is trading above the main SMAs suggesting a bullish momentum in the short-term.

- The level to beat for bulls is 1.3080. The next target to the upside is seen at 1.3125 and 1.3185 level.

- Support is at 1.3000 and 1.2960 level.

Additional key levels

GBP/USD

Overview:

Today Last Price: 1.3034

Today Daily change: -33 pips

Today Daily change %: -0.25%

Today Daily Open: 1.3067

Trends:

Daily SMA20: 1.2999

Daily SMA50: 1.2843

Daily SMA100: 1.2878

Daily SMA200: 1.3002

Levels:

Previous Daily High: 1.3074

Previous Daily Low: 1.2895

Previous Weekly High: 1.2959

Previous Weekly Low: 1.2773

Previous Monthly High: 1.3214

Previous Monthly Low: 1.2438

Daily Fibonacci 38.2%: 1.3006

Daily Fibonacci 61.8%: 1.2963

Daily Pivot Point S1: 1.295

Daily Pivot Point S2: 1.2833

Daily Pivot Point S3: 1.2771

Daily Pivot Point R1: 1.3129

Daily Pivot Point R2: 1.3191

Daily Pivot Point R3: 1.3308