When is the UK construction PMI and how could it affect GBP/USD?

UK construction PMI overview

Friday's UK economic docket features the release of construction PMI for the month of July, due for release at 08:30GMT. Consensus estimates point to a modest rebound to 46.0 in July from the previous month's dismal reading of 43.1 - marking its steepest decline since April 2009. Despite the uptick, the reading will mark the fifth month of contraction in the previous six and point to deteriorating business activity in the UK construction sector.

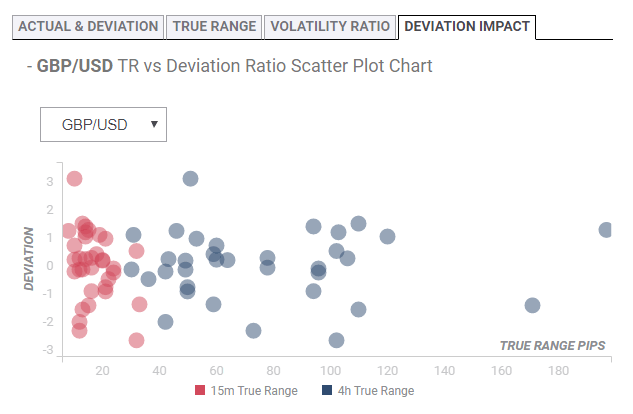

Deviation impact on GBP/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 20-25 pips in deviations up to +0.19 to -0.23 during the first 15-minutes, although in some cases, if notable enough, a deviation can fuel movements of up to 45-50 pips in the subsequent 4-hours.

How could affect GBP/USD?

Ahead of the release, the GBP/USD pair was seen trading with a mild negative bias, pivoting above the 1.2100 round figure mark. Against the backdrop of persistent Brexit-related uncertainties, a disappointing reading might be enough to prompt some fresh selling around the British Pound and turn the pair vulnerable to accelerate the slide further towards challenging the key 1.2000 psychological mark.

Alternatively, a stellar reading might not be enough to provide any meaningful respite for the bullish traders and hence, any meaningful attempted recovery seems more likely to fizzle out near the 1.2250 supply zone. However, a sustained move beyond the mentioned hurdle might prompt some short-covering move and assist the pair to aim back towards reclaiming the 1.2300 round figure mark.

Key Notes

• GBP/USD Analysis: BOE’s denial didn’t help the Pound

• GBP/USD stays within the negative phase – UOB

• GBP/USD technical analysis: Oversold RSI, key support-line stop sellers from sub-1.2000 region

About the UK construction PMI

The PMI Construction released by the Chartered Institute of Purchasing & Supply and Markit Economics shows business conditions in the UK construction sector. It is worth noting that the construction sector does not influence, either positively or negatively, the GDP as much as the Manufacturing sector does. A result that values above 50 signals appreciates (or is bullish for) the GBP, whereas a result that values below 50 is seen as negative (or bearish).