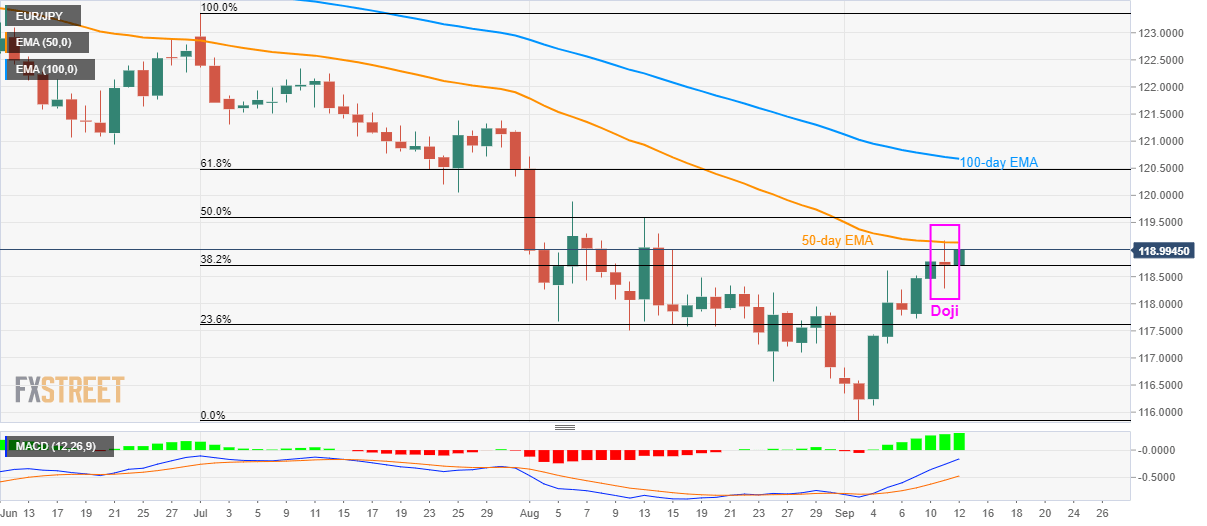

EUR/JPY technical analysis: Doji, 50-day EMA question bulls ahead of the ECB

- EUR/JPY again confronts 50-day EMA after registering a Doji candlestick formation on Wednesday.

- The bearish formation gets confirmed on the pair’s break below 118.25.

- An upside clearance of short-term EMA can aim for the 50% Fibonacci retracement level.

Despite trading near the highest levels in four-weeks, the EUR/JPY pair remains skeptical of further upside as it takes the bids to 119.00 ahead of the European session open on Thursday.

The Euro traders are awaiting the key event, namely monetary policy meeting by the European Central Bank (ECB), with most expecting a heavily dovish outcome as the President Mario Draghi will be heading the policymakers for the second-last time before he leaves the boat in October.

The negatives are pair’s trading below the 50-day exponential moving average (EMA) following Wednesday’s Doji candle formation on the daily chart.

As a result, sellers are waiting for a downside break below Tuesday’s low surrounding 118.25 in order to target 23.6% Fibonacci retracement level of July-September declines, near 117.60. Further, pair’s south-run past-117.60 can please sellers with a late-August low near 116.60 ahead of offering current month’s bottom around 115.85.

On the upside, pair’s successful break above 50-day EMA level of 119.13 could further escalate the recovery towards 50% Fibonacci retracement level of 119.60 and then to 120.00 round-figure. Additionally, 61.8% Fibonacci retracement and 100-day EMA, around 120.50 and 120.70 respectively, will entertain bulls afterward.

EUR/JPY daily chart

Trend: pullback expected