Back

26 Nov 2019

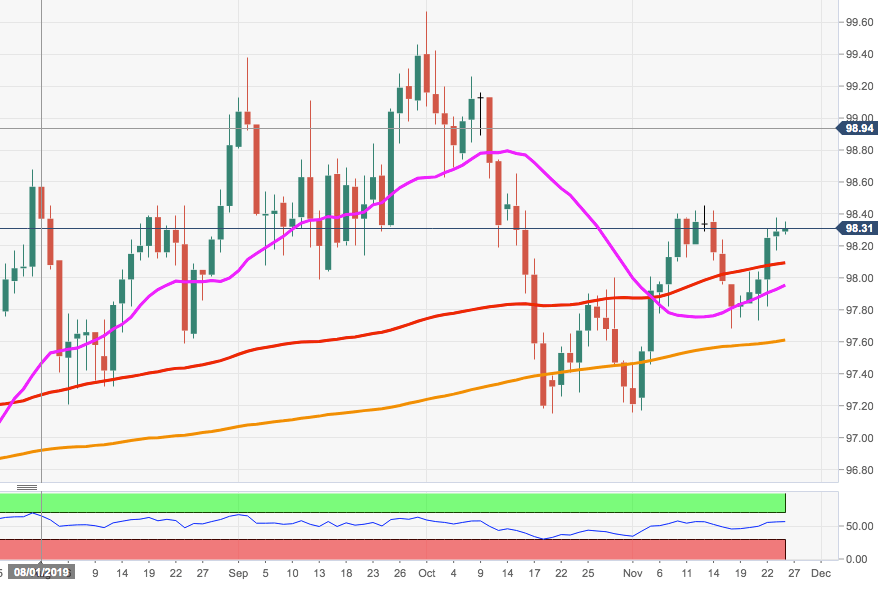

US Dollar Index Technical Analysis: Looks bid above 98.00. Targets the 98.50 region.

- The recovery in DXY remains well and sound above the 98.00 mark.

- Initial hurdle emerges at monthly peaks around 98.50.

The index so far manages well to keep business in the upper end of the range and above the 98.00 mark.

Further upside impetus should now target monthly tops in the 98.50 region. A sustainable break of this hurdle should pave the way for a move to the 99.00 hurdle and potentially beyond.

Looking at the broader context, the positive view on DXY is expected to remain unchanged while above the 200-day SMA, today at 97.58.