USD/MXN Price Analysis: Mexican peso strengthens to tease key trendline against the USD

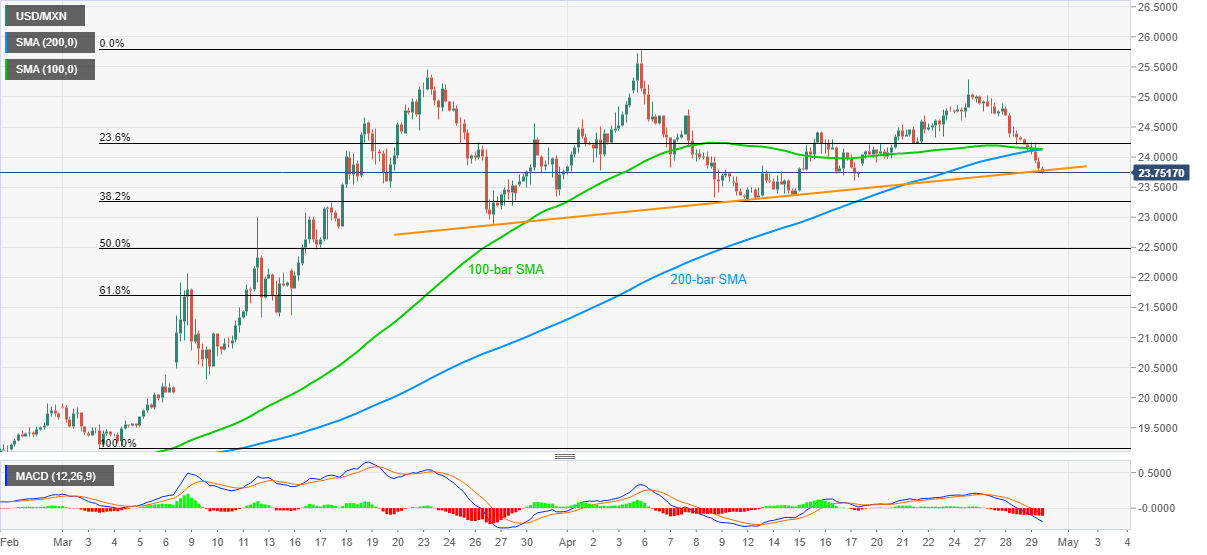

- USD/MXN seesaws near the lowest since April 17, pressured after a three-day losing streak.

- A sustained break of five-week-old support will enable sellers to question the monthly low amid bearish MACD.

- A confluence of 100-bar, 200-bar SMAs restricts immediate upside.

While extending its previous three-day losing streak, USD/MXN drops to 23.75 amid the early Asian session on Thursday. In doing so, the pair flirts with the five-week-old support line.

Given the pair’s sustained fall below a confluence of 100 and 200-bar SMAs, amid bearish MACD, sellers are likely to get a boost on the break of the key support line, currently near 23.75/70.

As a result, the monthly low near 23.28 can easily be challenged following the firm breakdown whereas March 26 low near 22.86 could lure the bears afterward.

Meanwhile, failures extend the downside below 23.70 needs to cross the key SMA confluence, around 24.10/15, to recall the 24.50 resistance.

It’s worth mentioning that the pair’s run-up beyond 24.50, enables it to aim for 25.00 and the previous week top surrounding 25.30.

USD/MXN four-hour chart

Trend: Bearish