Back

18 May 2020

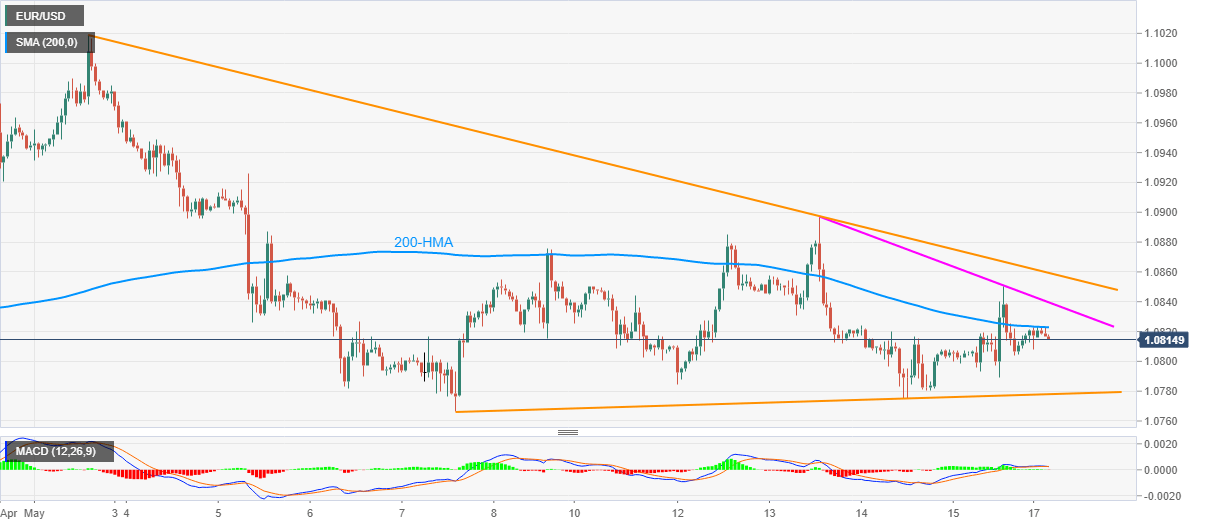

EUR/USD Price Analysis: Pressured below 200-HMA inside short-term triangle

- EUR/USD struggled to extend Friday’s recovery moves.

- A three-day-old falling trend line adds to the resistance.

- April month low will lure the sellers below triangle breakdown.

EUR/USD drops to 1.0815 during the early Monday trading session. In doing so, the quote stays depressed below 200-HMA while also staying inside a short-term triangle formation.

Although the pair’s immediate failures to cross 200-HMA drags it towards 1.0800 mark, the formation support, at 1.0775 now, will keep the sellers in check.

Should there be a clear break below 1.0775, April month bottom surrounding 1.0730/25 will be the bears’ favorite.

On the contrary, an upside break of 200-HMA level of 1.0823 will push the pair towards a three-day-old resistance line, at 1.0840 now.

Though, the pair’s further rise past-1.0840 will be hindered by the said triangle’s resistance line near 1.0860.

EUR/USD hourly chart

Trend: Bearish