Gold Price Analysis: XAU/USD has $1,906 in its cross hairs as it recovers – Confluence Detector

Gold has been clawing its way back up after the hit coming from another promising coronavirus vaccine. For the second Monday in a row, a pharmaceutical company published upbeat news about its late-stage COVID-19 immunization trial – sending the precious metal down.

The prospects of a faster exit from the crisis imply less fiscal and monetary stimulus from authorities – fewer funds to push XAU/USD higher. Nevertheless, gold has been recovering, finding fresh demand. How is it positioned technically?

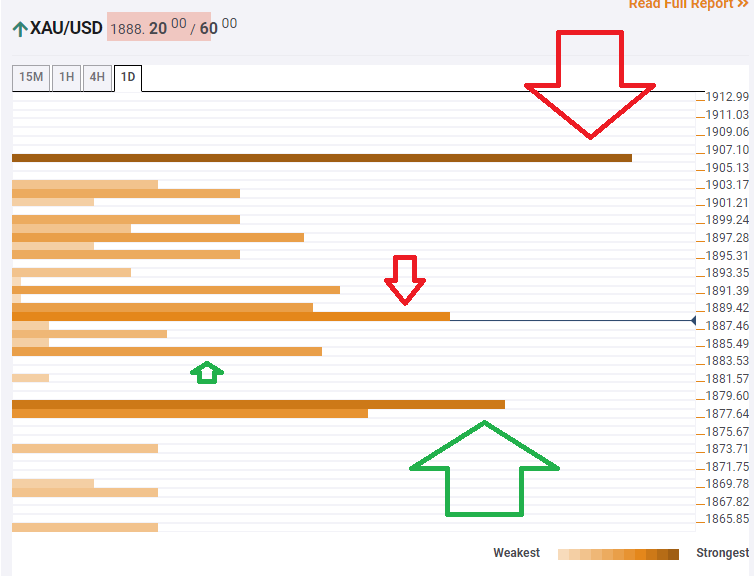

The Technical Confluences Indicator is showing that gold is facing immediate resistance at around $1,888, which is the convergence of the Fibonacci 38.2% one-month, the Simple Moving Average 10-4h, the SMA 1001-5m, and others.

A critical cap awaits at $1,906, which is a juncture of lines including the Fibonacci 61.8% one-month, the 50-day, and 100-day SMAs.

Some support awaits at $1,884, which is the confluence of the Bollinger Band 4h-Middle and the previous 4h-low.

A more significant cushion is at $1,877, which is where the Fibonacci 23.6% one-week, the Fibonacci 38.2% one-day, and the SMA 5-one-day converge.

Key XAU/USD resistances and supports

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence