AUD/JPY Price Analysis: Sellers attack key entry barriers starting from 80.00

- AUD/JPY struggles to hold 80.00 amid fresh easing.

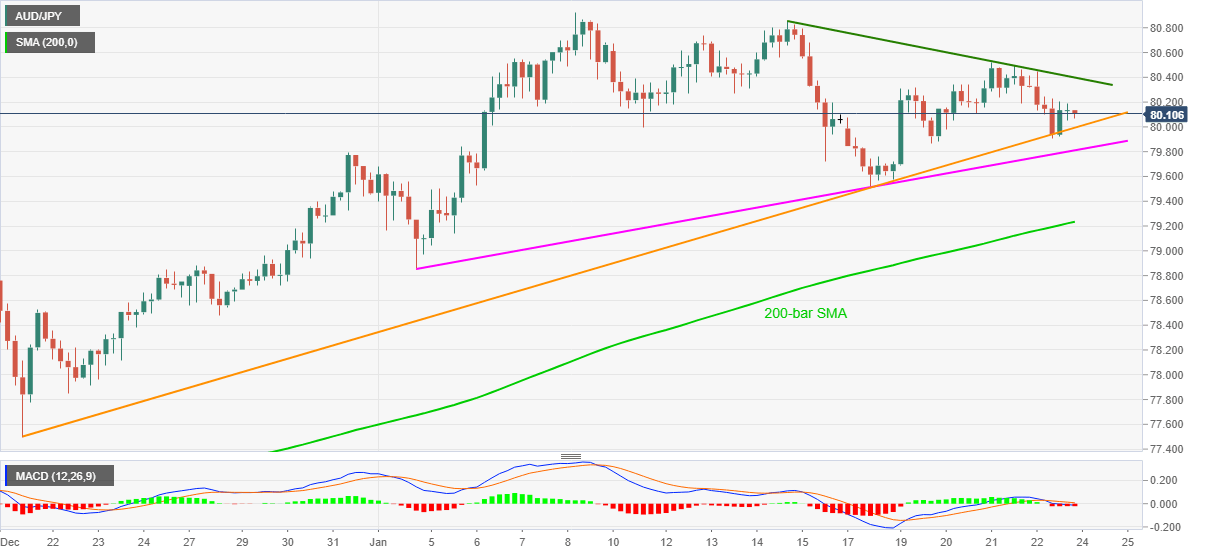

- Key trend line supports precede 200-bar SMA to challenge immediate downside.

- Seven-day-old falling trend line restricts nearby upside momentum.

AUD/JPY remains depressed around 80.00, currently near 80.10, as Asian traders roll-up their sleeves for Monday. In doing so, the quote fades Friday’s bounce off an ascending trend line from December 21 amid bearish MACD. Also suggesting the quote’s weakness is a downward sloping resistance line from January 14.

As a result, AUD/JPY sellers battle with the 80.00 round-figure comprising the five-week-long support line. It should, however, be noted that an ascending trend line from January 04, currently around 79.80, adds to the downside filter.

In a case where AUD/JPY bears dominate past-79.80, 200-bar SMA level around 79.20, the 79.00 threshold and the monthly bottom near 78.80 will be in the spotlight.

Meanwhile, an upside clearance of a seven-day-old resistance line, at 80.40 now, will recall the AUD/JPY buyers targeting the monthly top, also the highest since December 2018, near 80.95.

During the quote’s further upside past-80.95, the 81.00 round-figure will be the key as it holds the gate for the pair’s rise towards December 13 2018 high near 82.20.

AUD/JPY four-hour chart

Trend: Further weakness expected