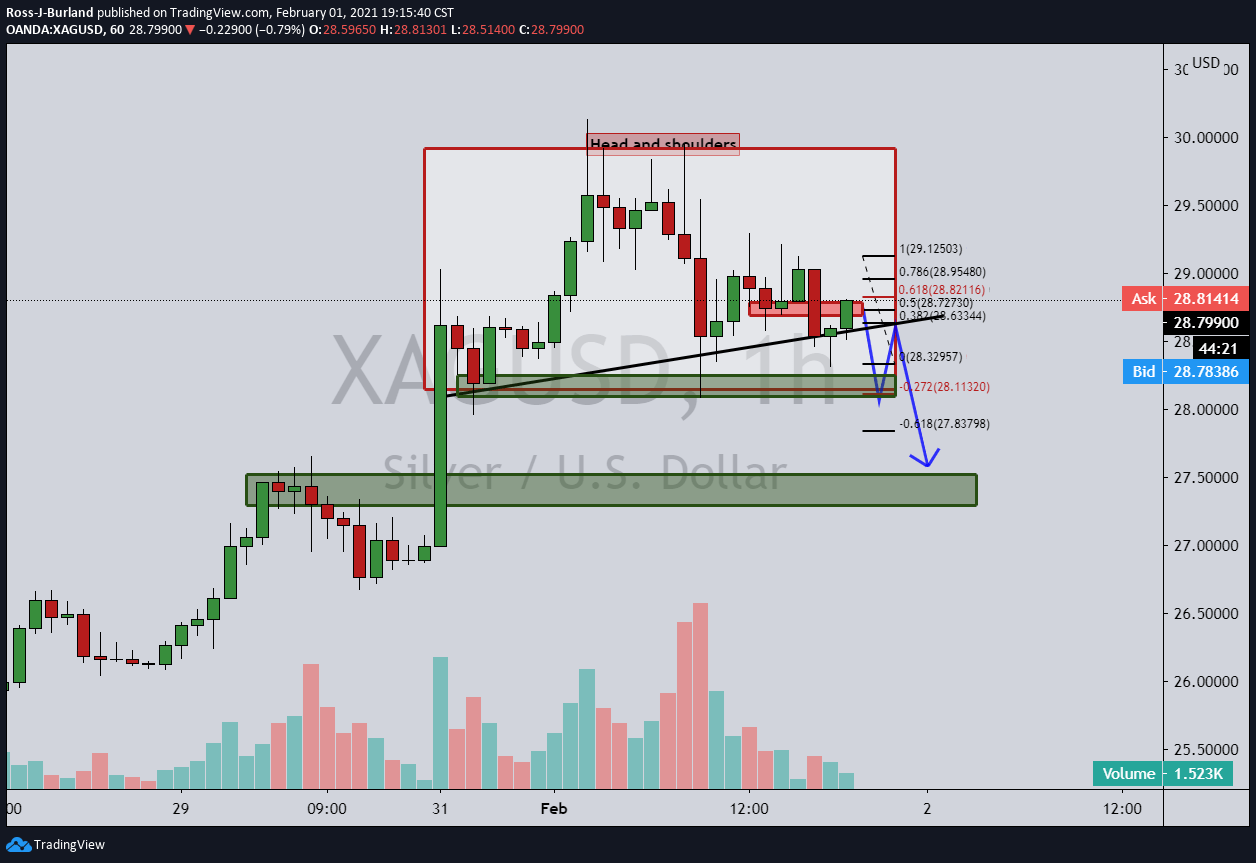

Silver Price Analysis: Bears eyeing a break of hourly supports to $27.50

- XAG/USD on the verge of a break of the H&S neckline.

- The risk to 27.50 is on the cards while below 29.50.

The price of silver is in the limelight again on Tuesday as it drops to test support and forms an hourly head and shoulders pattern following heavy sell-side tick volume emerging at the start of the New York day.

At the time of writing, the price is trading at $28.5470 and is down -1.66% having travelled between a high of $29.0280 and $28.3205.

A recent 'buyers beware' piece from HSBC was circulating that argues amateur traders following the type on social media will 'tire' and start to sell.

This follows the announcement the CME futures exchange as raised he margin requirement on silver futures by 18%.

Silver technical analysis

Meanwhile, the following is an analysis from a technical basis that illustrates the downside corrective potential, something that was highlighted in this week's The Chart of the Week on Monday and again today in the following gold article:

Gold Price Analysis: XAU/USD preparing for take-off from daily structure

''...a deeper correction could be on the cards if support gives way, with eyes on a 50% mean reversion of the daily lows and highs.''

4-hour chart

-637478006494237034.png)

1-hour chart

As can be seen, there was heavy selling volume followed by weaker buying volume and a subsequent right-hand shoulder formed in the latest spurt of offers.

The price is retesting the old support that would be expected to act as resistance and possibly give way to a test of the neckline and primary support before giving way to the $27.50s major support.

The thesis will be nullified if bulls can get back and hold above $29.0280 highs that guard a break to $29.50s resistance.