Gold Price Analysis: XAU/USD path of least resistance is up after whipsaw – Confluence Detector

- Gold has recovered from its lows as the market mood improved.

- The Confluence Detector is showing that XAU/USD's path of least resistance is up.

- Gold Price Analysis: XAU/USD rallies back closer to multi-month tops, around $1,840 region

Inflation fears are rising – as seen in both the Consumer Price Index figures and the University of Michigan's Consumer Sentiment data. Is gold still a hedge against rising prices? That remains debatable, but the increase in the precious metal's value is clear. It is more related to the Federal Reserve's insistence that any such move is transitory.

Where next for gold price from here?

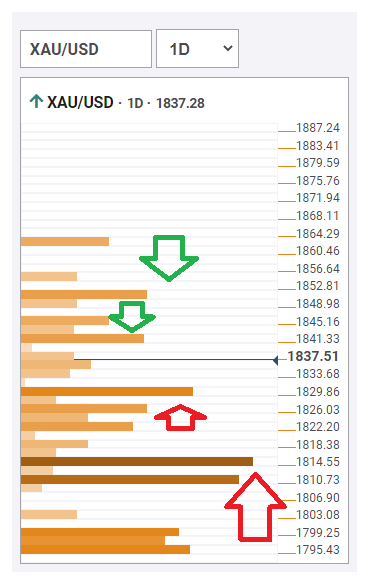

The Technical Confluences Detector is showing that XAU/USD has some support at $1,829, which is the convergence of the Simple Moving Average 5-4h, the previous daily high, the Bollinger Band one-hour Middle, the 5-day SMA and more.

The gold price has an even more significant cushion at $1,814, which is the meeting point of the Pivot Point one-day Support 1 and the Fibonacci 38.2% one week.

Looking up, some resistance awaits at $1,841, which is the confluence of the BB one-day Upper, the PP one-day Resistance 2 and more.

Another minor cap is at $1,850, which is where the PP one-month R2 hits the gold price.

All in all, XAU/USD has strong support and weak resistance, pointing to further gains.

XAU/USD resistance and support levels

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence