Crude Oil Futures: Downside seen limited

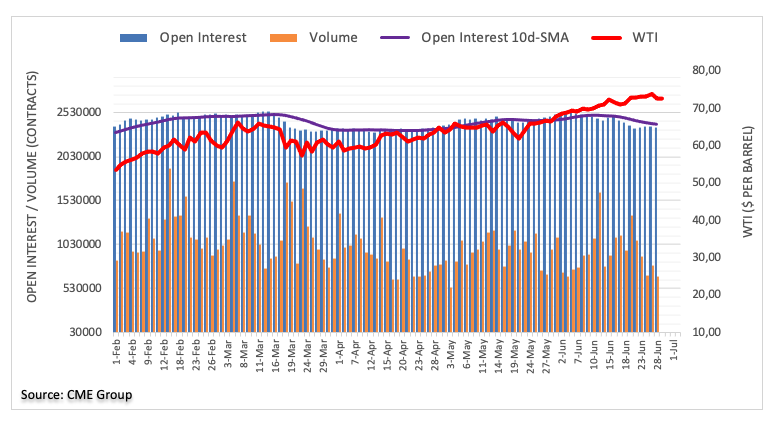

CME Group’s preliminary readings for crude oil futures markets noted traders scaled back their open interest positions by around 7.6K contracts at the beginning of the week, reaching the second drop in a row. Volume followed suit and went down by around 132.6K contracts.

WTI faces the next support around $70.00

Prices of the WTI started the week on a negative footing despite clinching fresh highs above the $74.00 mark per barrel, levels last recorded in October 2018. While Monday’s bearish outside day plus the vicinity of the overbought territory calls for further decline, shrinking open interest and volume coupled support the idea that a deeper retracement is not favoured for the time being. Against this, the $70.00 mark per barrel now emerges as quite a decent contention for oil bears.