AUD/JPY Price Aanlysis: Bulls attempt to squeeze more juice from the rally

- AUD/JPY is trading better-bid at the end of the week.

- The cross is on the verge of a higher high ahead of the NFP event and RBA's SoMP.

AUD/JPY has been on the front foot for the start of the month, rising from the low 80s and challenging the prior daily corrective closing highs near 81.50 with an advance through 81 the figure and reaching as high as 81.31 in New York.

For the final sessions of the week, there are prospects of an onward continuation.

On break and hold above 81.30, bulls will be in charge of the key events on the calendar.

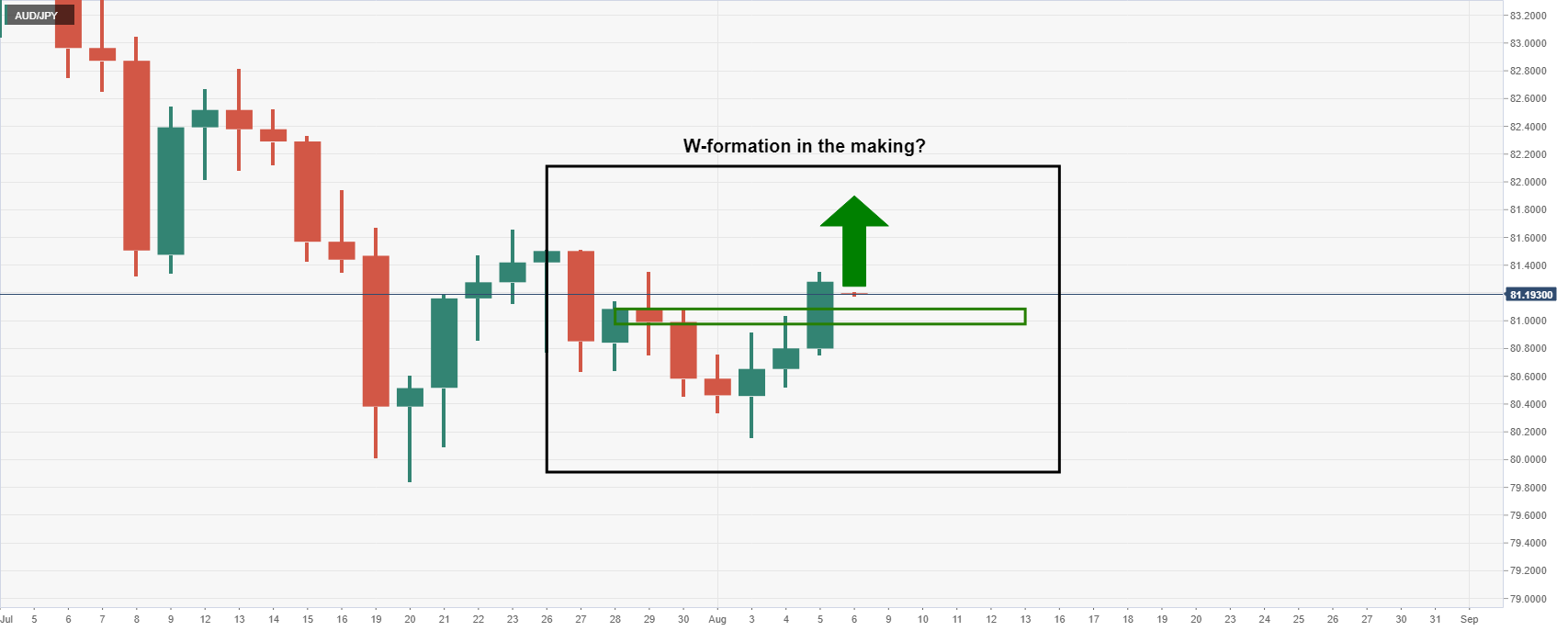

Daily chart

The price is embarking on a continuation and in doing so it will form a common pattern in a W-formation.

However, this requires that the day ends with a higher high and close, so any pullback should be only to fuel the upside continuation on Friday.

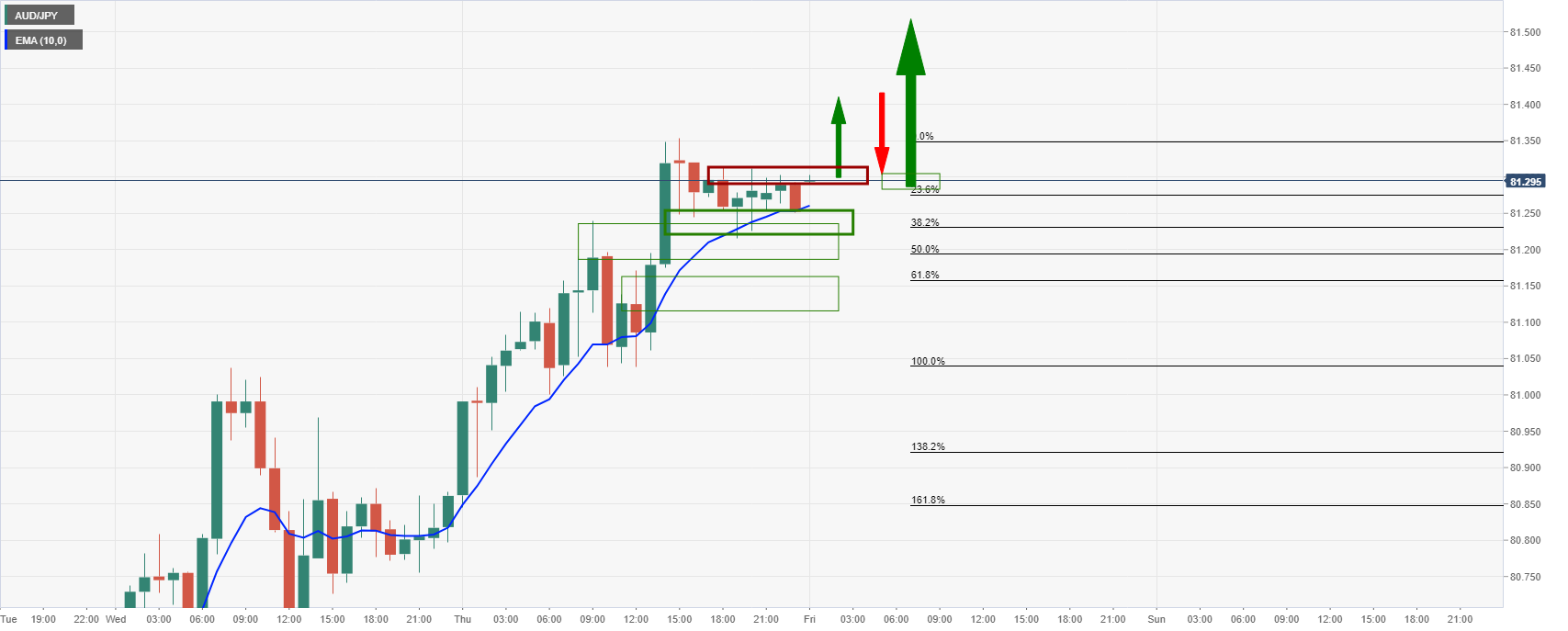

Hourly chart

The bullish scenario is as follows:

The price is supported by the rising 10 EMA and the confluence of prior hourly highs.

The overall momentum is with the bulls longer term but it is fading in Asia, which brings us to the bearish scenario:

A break of the lows in the sideways consolidation in 81.217, the bears will seek a test of the W-formation's highs near 81.17.

Below there, the bears will be in control and seeking a test of 81 the figure.